Is Allowance Taxable In Malaysia

These proposals will not become law until their enactment and may be amended in the course of their passage through.

Is allowance taxable in malaysia. According to lhdn foreigners employed in malaysia must give notice of their chargeability to the non resident branch or nearest lhdn branch within 2 months of their arrival in malaysia. Firstly pensions paid to people after reaching the age of retirement are exempt from tax under schedule 6 paragraph 30 of the income tax act 1967. One limitation of this.

Only tax exempt allowances perquisites gifts benefits listed above no. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. The malaysian taxation system is an essential core subject in accounting and business in malaysia.

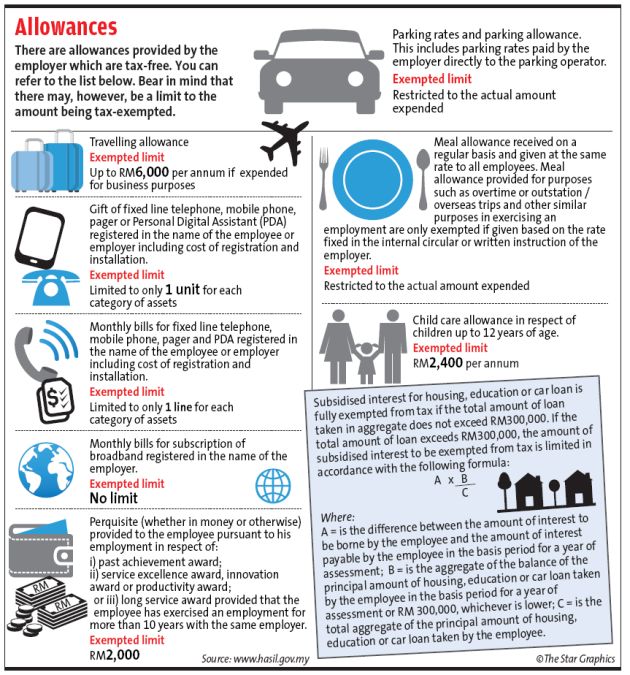

Car allowance is exempted up to rm6000 pa frm tax was created by dextra engineering malaysia sdn bhd dear kc i also noticed that your pcb calculation does not exclude the exempt portion of the car allowance ie rm500 per month rm6000 12 resulting in higher tax being paid. Malaysia has always been considered a tax friendly country. Here are the 14 tax exempt allowances gifts benefits perquisites.

This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. Petrol allowance petrol card travelling allowance or toll payment or any combination. Tax exemptions either reduce or entirely eliminate your obligation to pay tax.

Income tax in malaysia is comparably low and many taxes which are raised in other countries do not exist in malaysia. It feels really bad if you still have to pay income tax after retiring but good news malaysians don t pay any tax on that. You are required to pay taxes for your income arising from any rent received but there is a 50 tax exemption in this category for malaysian resident individuals.

For income tax filed in malaysia we are entitled to certain tax exemptions that can reduce our overall chargeable income. It ll also apply when the pension is paid due to retirement from ill health or if the pension is paid under any other approved fund even if you have not reached the legal age of retirement. Fortunately taxpayers in malaysia are not taxed on our total income as certain portions of our income are tax exempted.

In malaysia employees are allowed to claim tax exemptions for the benefits perquisites below unless the employee has shareholding or voting power in the company. The exemption is limited to rm2 000 per month for each residential home rented out and the residential home must be rented under a legal tenancy agreement. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.

Others allowances perquisites gifts benefits which are exempted from tax but not required to declare in part f of form ea are as below. Also the exemption is given for a maximum of three consecutive years. 1 to 8 are required to declare in part f of form ea.

The sales and services tax sst implemented on 1 september 2018. Green technology educational services.