Ipo Process In Malaysia

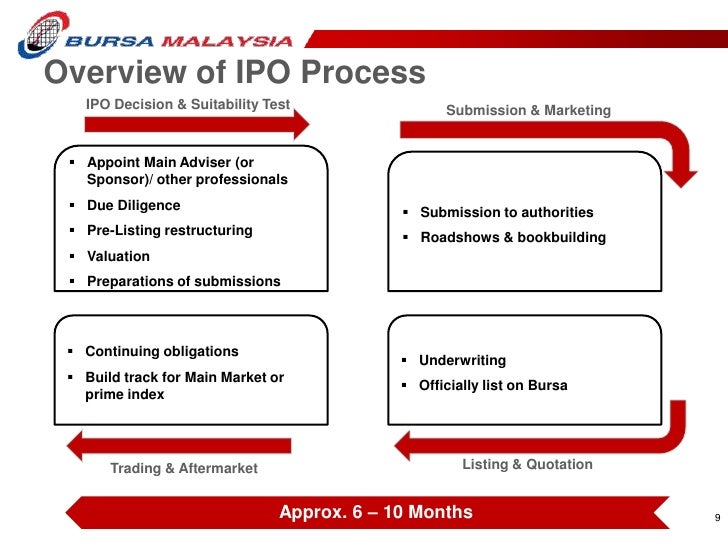

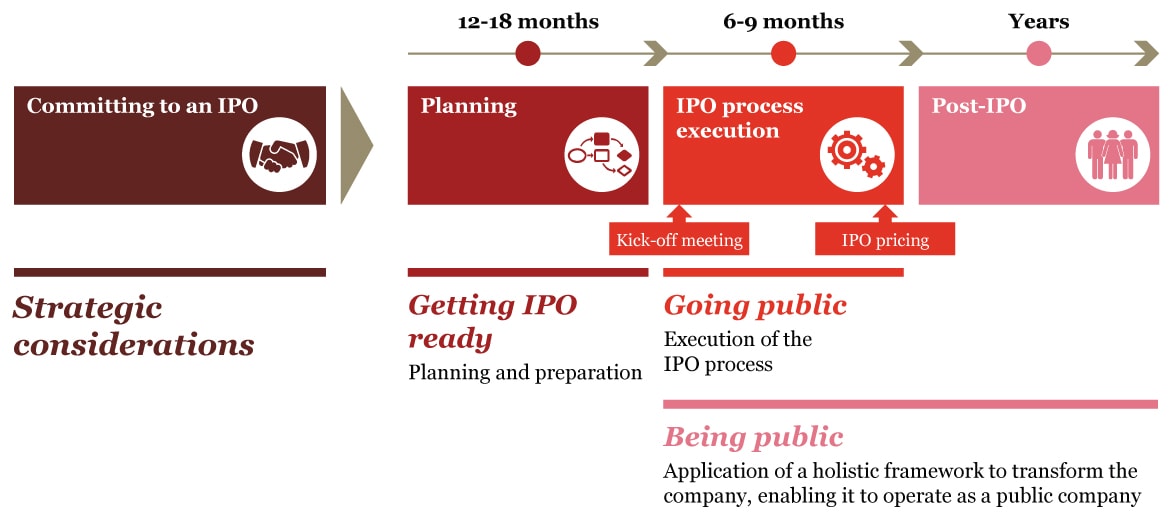

Listing your company is a process that can take anywhere between seven months up to 12 months but may be shorter or longer depending on factors such as due diligence work availability of the latest audited accounts and the size and complexity of the ipo.

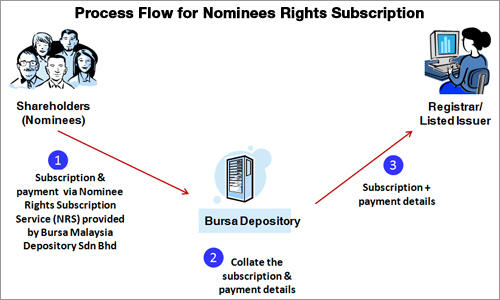

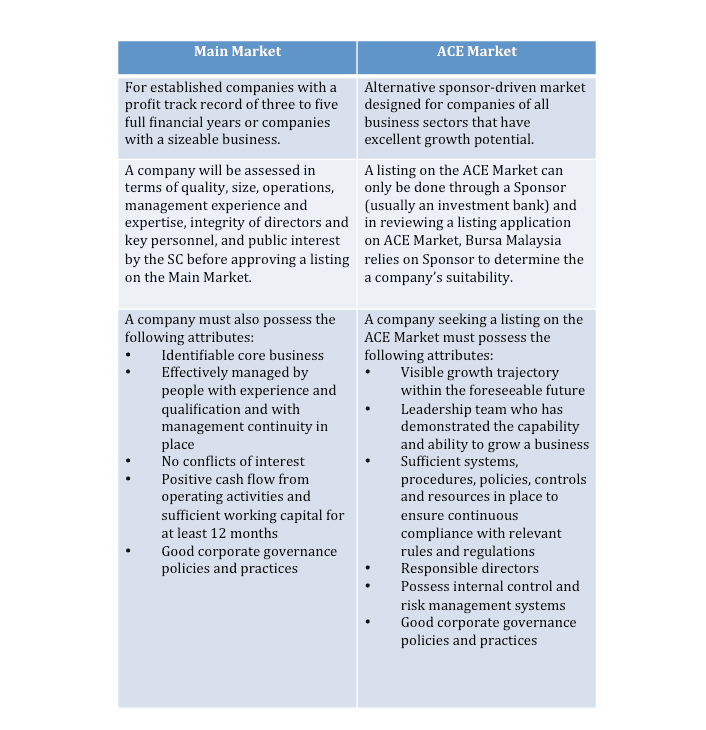

Ipo process in malaysia. Home listing listing resources ipo ipo. The initial public offering ipo process is where a previously unlisted company sells new or existing securities marketable securities marketable securities are unrestricted short term financial instruments that are issued either for equity securities or for debt securities of a publicly listed company. In addition a prospectus issued in conjunction with the listing must be registered with the sc.

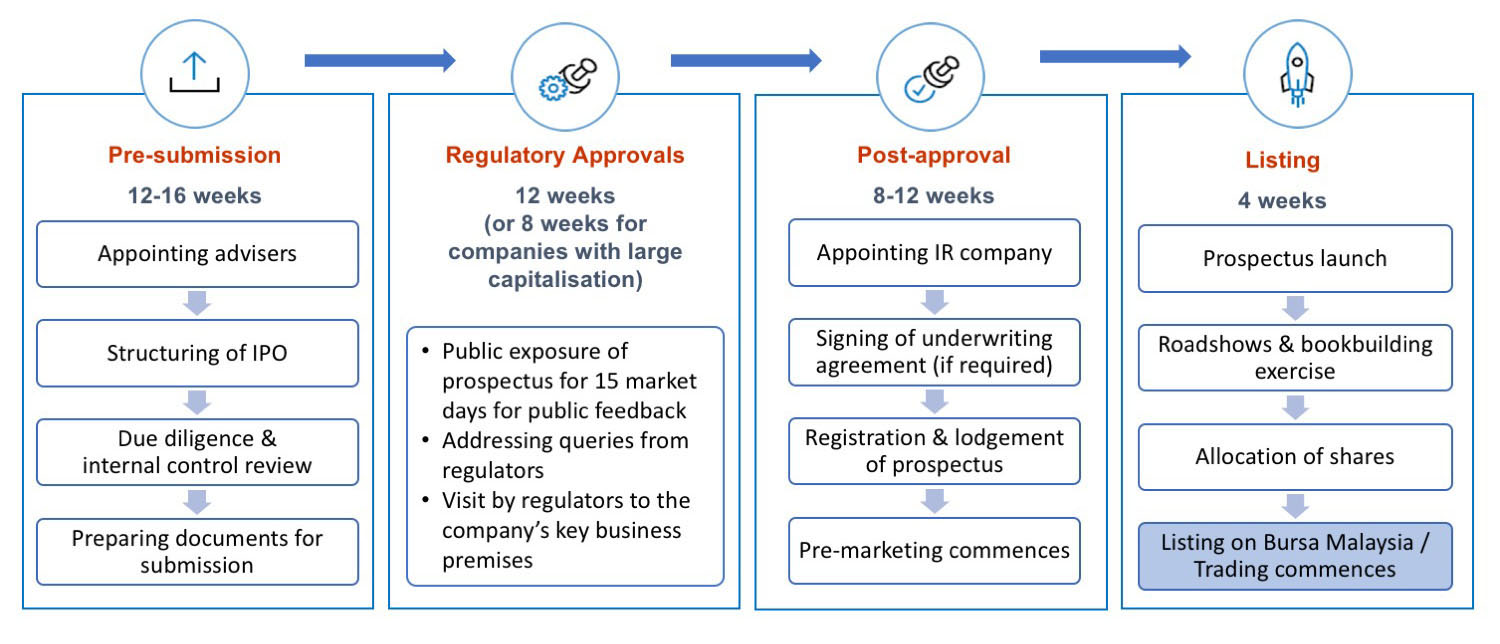

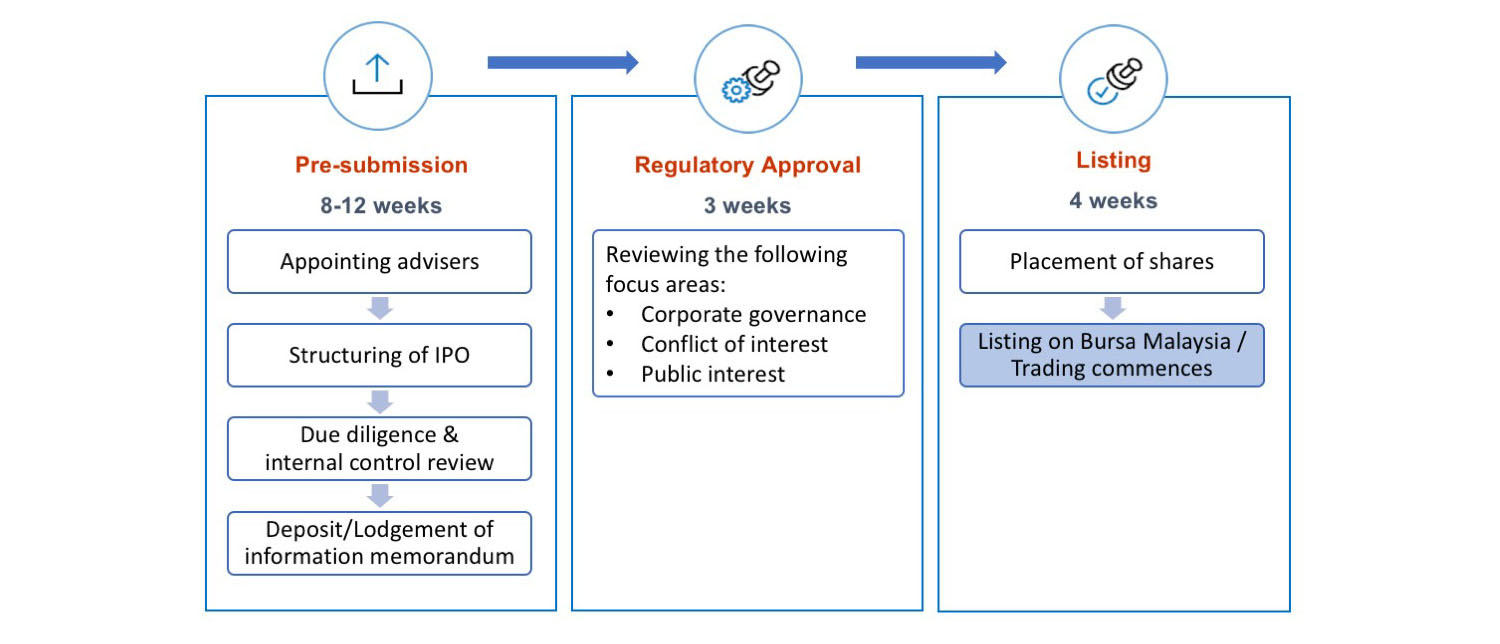

The conceptual timeline for the listing process is as follows. For listing enquries please email email protected. The approval process of main market ipos in malaysia.

A patent is an exclusive right granted for an invention which is a product or a process that provides in general a new way of doing something or offers a new technical solution to a problem. If not the company itself will reach out to bankers and invite them in to pitch for the business. Last tuesday the securities commission malaysia announced an enhanced initial public offering ipo framework for listings on the main market of bursa malaysia that is expected to create a more seamless and efficient ipo process for all parties particularly as problems will be flagged earlier.

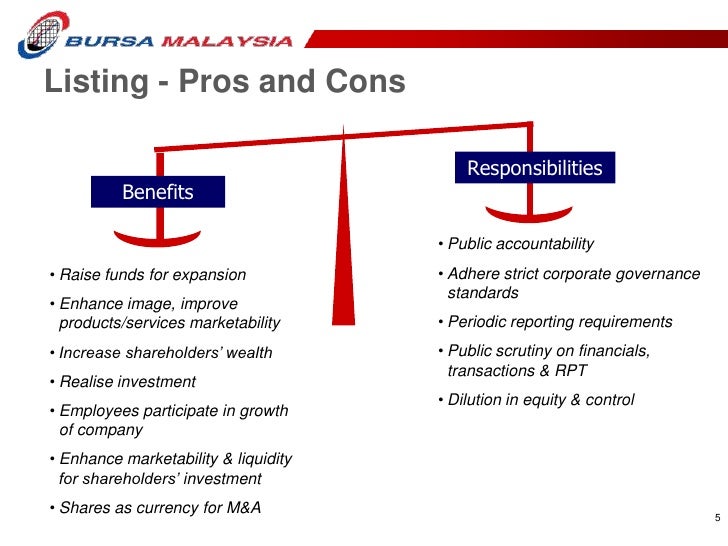

For main market applications the sc will generally complete its assessment and register the ipo prospectus within 60 working days from the date of a full. The journey to list your company on bursa malaysia is a long. The issuing company creates these instruments for the express purpose of raising funds to further finance business activities and expansion.

A utility innovation is an exclusive right granted for a minor invention which does not require to satisfy the test of inventiveness as required of a patent. The listing process from the time you engage an adviser to the day of listing will normally take four to nine months depending on the structure and complexity of the listing scheme. Gas malaysia malaysia malaysia 233m the sole licensed seller of natural gas in peninsular malaysia.

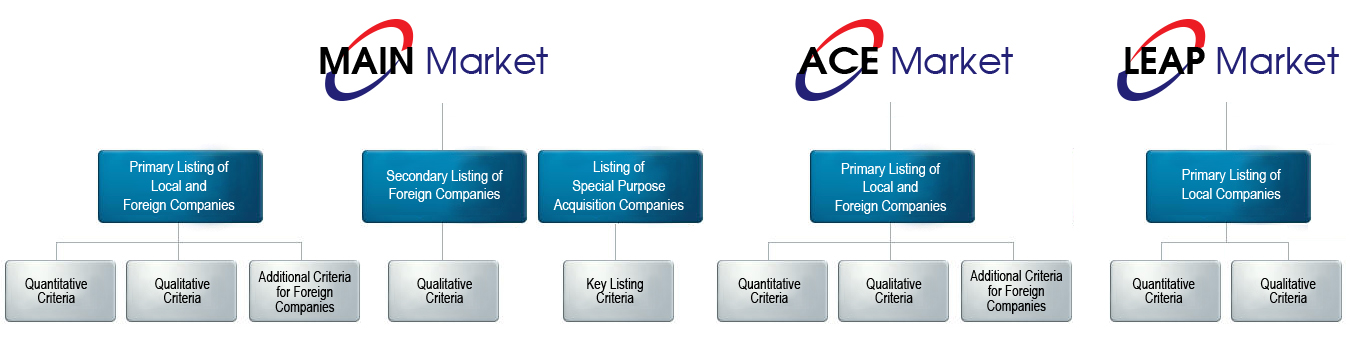

The issues committee comprising different members of the commission convenes to deliberate and decide on the ipo application. Here are the steps involved. All companies seeking listing on bursa malaysia will require sc s approval under section 212 of the capital market and services act 2007.

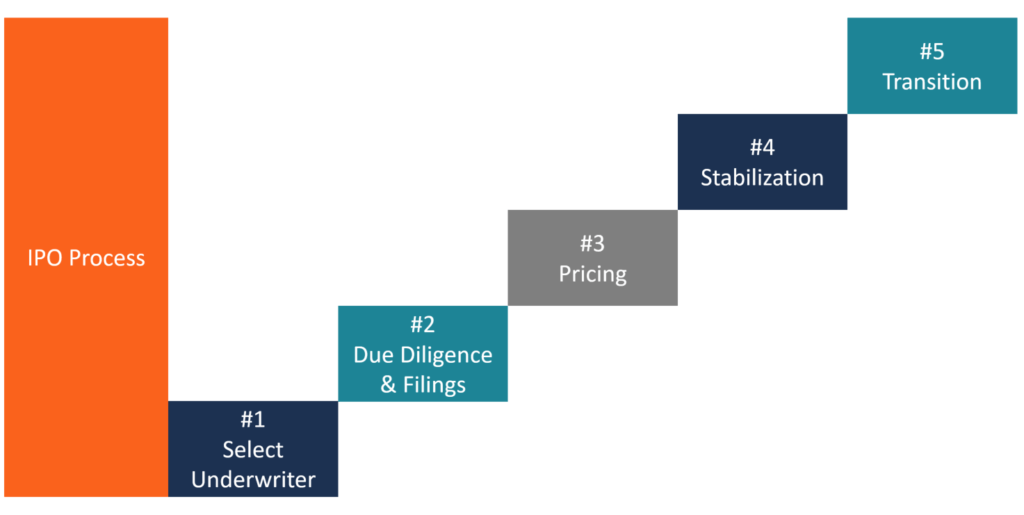

Challenge process to ensure thoroughness and consistency in the recommendation of the application to be tabled to the issues committee. Rules making process about bursa malaysia regulatory. Execution of ipo process ipo post ipo being public change programme to enable company to operate effectively as a public company readiness assessment implementation plan project set up delivering the ipo embedding change 3 12 months 4 6 months 12 24 months slide 19 pwc asia school of.

In most cases bankers from many firms have been speaking with the company in question and developing relationships for years so they re likely to know the company s intentions well in advance. Up and coming ipos as well as listing statistics can be found here. Ipo allows a company to raise capital.

Corporate governance sustainability. The initiative is understood to be the result of the regulator s engagement with industry players over the past few years over issues faced in the ipo process.