Housing Loan Interest Rate In Sbi

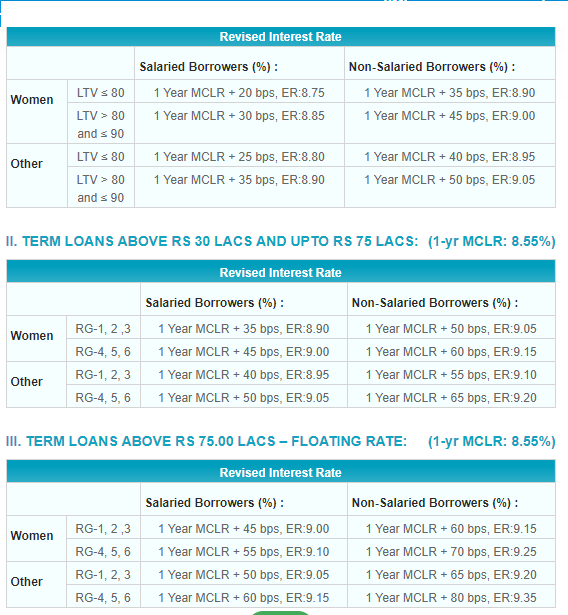

Sbi interest rate for self employed and high risk individuals sbi home loan rate for self employed.

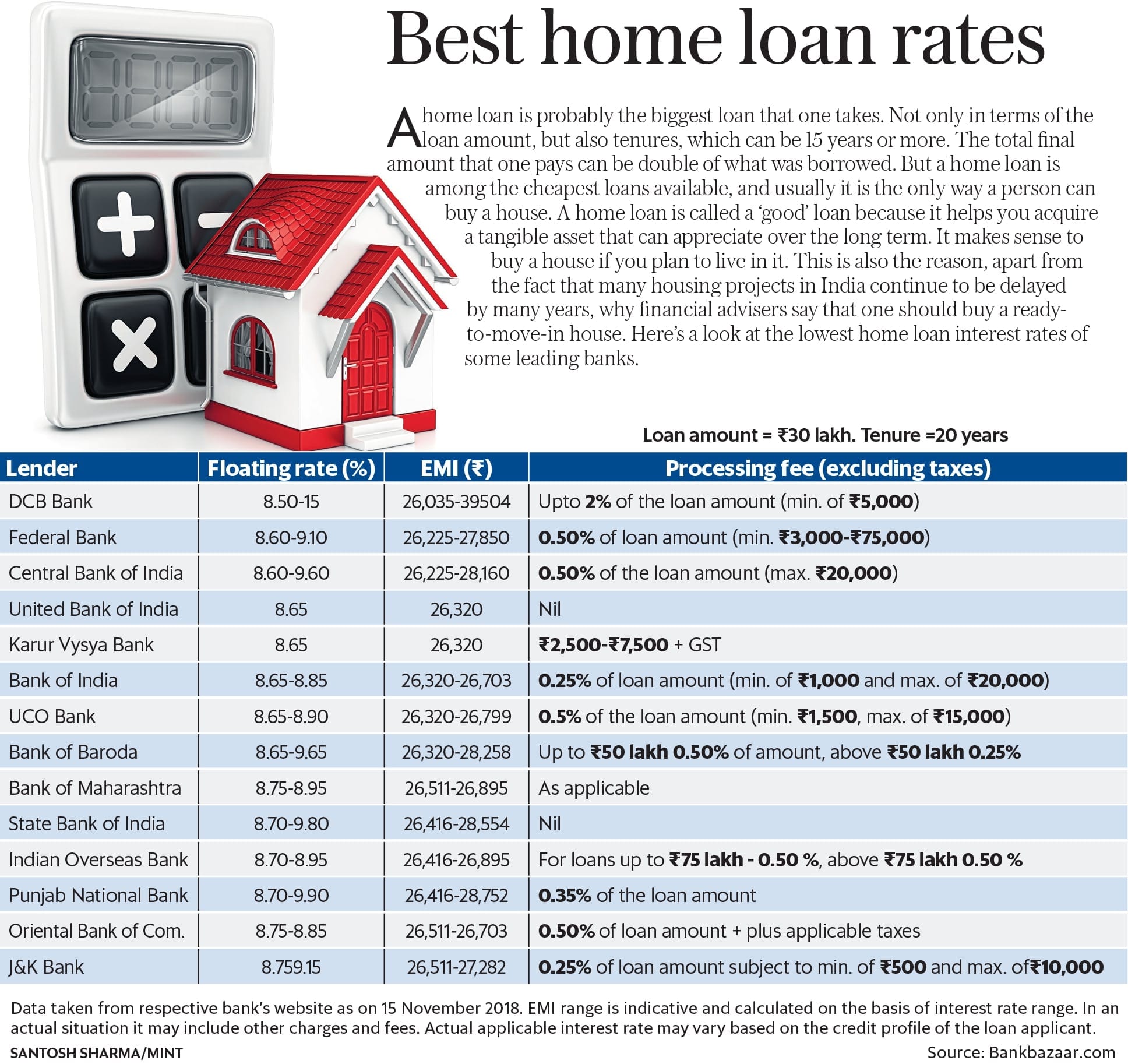

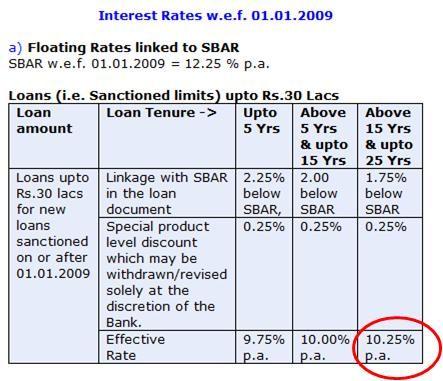

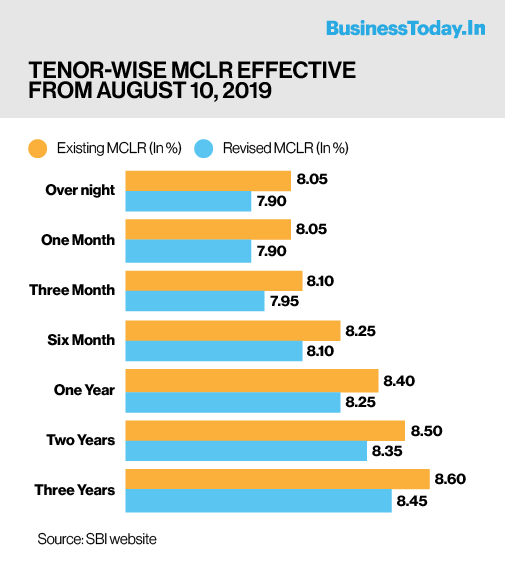

Housing loan interest rate in sbi. It offers customer the flexibility to pay only interest during initial 3 5 years and thereafter in flexible emis. Sbi links its home loan interest rates to its 1 year mclr. Sbi offers home loan for women at 7 90 to 7 95.

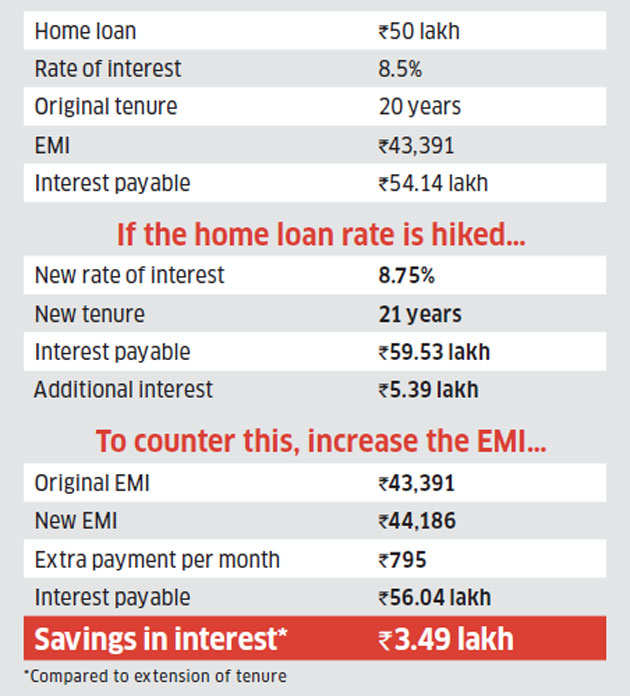

The flexipay calculator allows you to calculate the emi division that you pay during the home loan tenure. You work hard for your money and you want you money to work hard for you. A premium of 05 bps will be added for the customers who is not having salary account with sbi b home top up card interest rate structure floating.

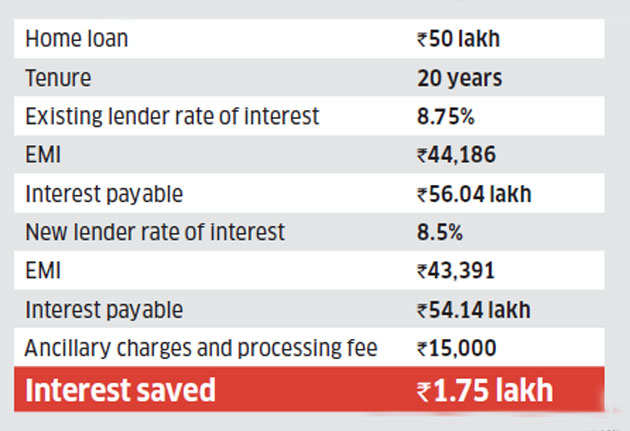

Following the reduction in the rates sbi home loan rates starts at 6 95 p a. Self employed individuals have to pay 15 basis points more than the average rate. How much amount do you need to pay each month to the lender.

State bank of india sbi the country s largest lender has cut its lending rates. The interest rate range for salaried individuals when it comes to home loans ranges between 6 95 p a. Individuals can apply for sbi home loan for the purchase of ready built under construction pre owned properties.

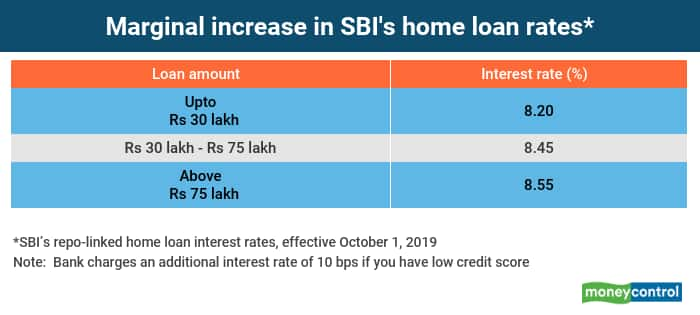

Sbi home loan is available from 6 95 percent to 7 35 percent. Sbi home loan current interest rate sbi is the first choice for all home loan borrowers in india. Sbi personal loan interest rates starting at 9 60 with low emi and easy payment options.

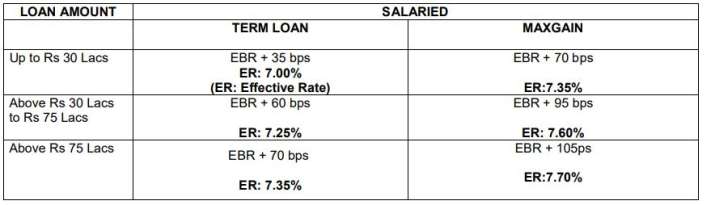

Sbi home loan interest rates latest update as on september 2020. They have different rates for term loans and overdrafts as is evident from the interest rate tables furnished below. Sbi flexipay home loan provides an eligibility for a greater loan.

It comes with a range of benefits such as flexible tenure no prepayment penalty and low processing fees. This variant of sbi home loan is very useful for young salaried between 21 45 years. This means for loans up to rs 30 lakhs they have to pay 7 15 interest.

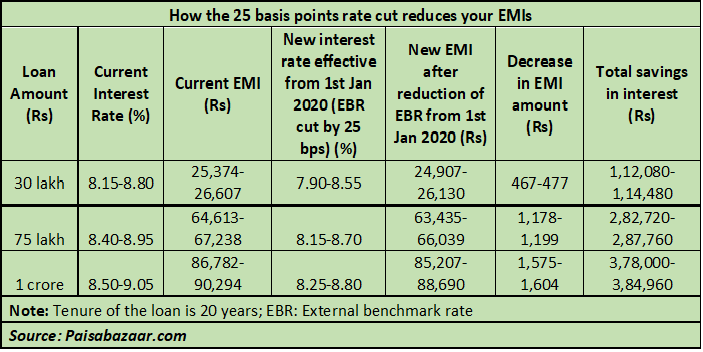

Women borrowers in this category would pay 7 05 interest. At present after back to back policy rate ebr or external benchmark linked home loan. This is an awareness video for the general public about the new changes in the interest rate.

Low interest rates have made things very difficult for savers over the last decade since the economic crash of 2008. The countrys top lender sbi has allowed its current home loan borrowers to switch to repo linked interest rate. As of 1 st january 2020 its applicable 1 year mclr is 7 90.