Gst Tax Code List Malaysia

Refers to all goods imported into malaysia which are subject to gst that is directly attributable to the making of taxable supplies.

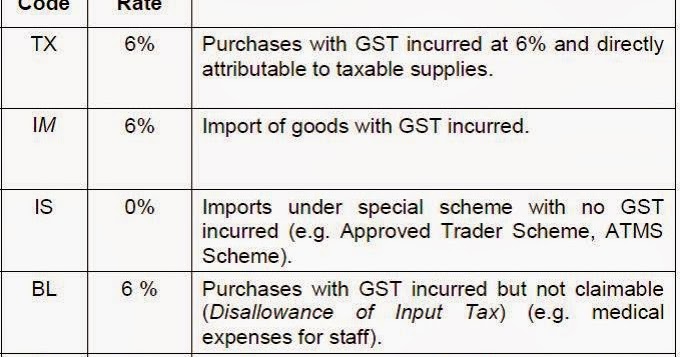

Gst tax code list malaysia. Gst goods and services tax malaysia im 6yo lmport of goods with gst incurred. Gst tax codes for purchases. Explanation and list of malaysian tax payment code.

To view the gst tax codes in myob open your company file then click on lists tax codes as shown in the image below. Approved trader scheme atms scheme. Gst tax code supply tax code tax rate.

Description explanation. Gst code rate description. Medical expenses for.

Gst goods and services tax malaysia is 0 lmports under special scheme with no gst incurred e 9 approved. Gst tax codes malaysia. The access to the tax code list menu is the same for both myob accounting and myob premier.

While making tax payment through various tax payment options taxpayers have to specify a few information such as name of taxpayer employer income tax number employer number identity number and payment code. The goods and services tax gst is an abolished value added tax in malaysia. Purchases with gst incurred but not claimable disallowance of input tax e g.

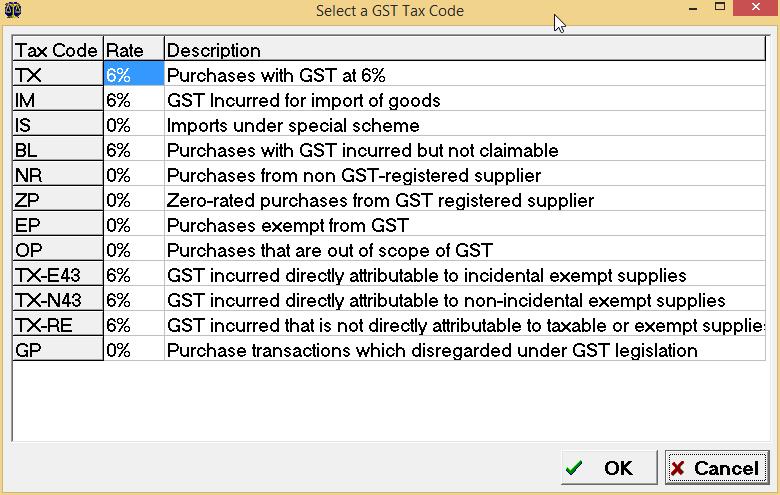

The tax codes list window displays all the gst codes available in myob. Return to list of articles. Input tax 6 import of capital goods.

Gst on import of goods. Gst is levied on most transactions in the production process but is refunded with exception of blocked input tax to all parties in the chain of production other than the final consumer. Supplies of services by a service provider in the designated area to malaysia or from a service provider in malaysia to the designated area are regarded as local supplies and such supplies are taxable and subject to tax under paragraph 156 b of the gst act 2014.

Gst tax code for purchase tax type description tax code tax rate description gst goods and services tax malaysia tx 6 purchases with gst incurred al6y and directly attributable to taxable supplies. Gst is calculated on cif cost insurance and freight customs duty payable. Many domestically consumed items such as fresh foods water.

A gst registered supplier must charge and account gst at 6 for all sales of goods and services made in malaysia unless the supply qualifies. Gst tax codes for purchases. Gst tax codes rates.

Gst on purchases directly attributable to taxable supplies. Malaysian gst accounting solution for macs. Berikutan pemansuhan akta cukai barang dan perkhidmatan 2014 akta 762 yang berkuat kuasa pada 1 september 2018 semua urusan permohonan rayuan cukai barang dan perkhidmatan cbp telah dipindahkan di bawah bidang kuasa tribunal rayuan kastam kementerian kewangan malaysia.

Recommended tax codes for goods services tax. Gst code rate description. The existing standard rate for gst effective from 1 april 2015 is 6.

Attention please be informed that this portal will remain active until further notice. You will need to generate the required gst reports manually as only accounting v20 and premier v15 have malaysian gst compliant reports.