Gst Start In Malaysia

Goods and services tax gst in malaysia the ministry of finance mof announced that starting from 1 june 2018 the rate of the goods and service tax gst will be reduced to 0 from the current 6.

Gst start in malaysia. Thus the changes in malaysia s gst and sst will not impact labuan nor applicable to labuan companies. Malaysia gst reduced to zero. Malaysia gst reduced to zero.

This number tracks your business through the system. Overview of goods and services tax gst in malaysia the ministry of finance mof announced that starting from 1 june 2018 the rate of the goods and service tax gst will be reduced to 0 from the current 6. For more information regarding the change and guide please refer to.

It is a designated area and are exempted from malaysia s gst. For more information regarding the change and guide please refer to. Ultimately you will receive a gst registration number which establishes you in the malaysia tax system as a legal business.

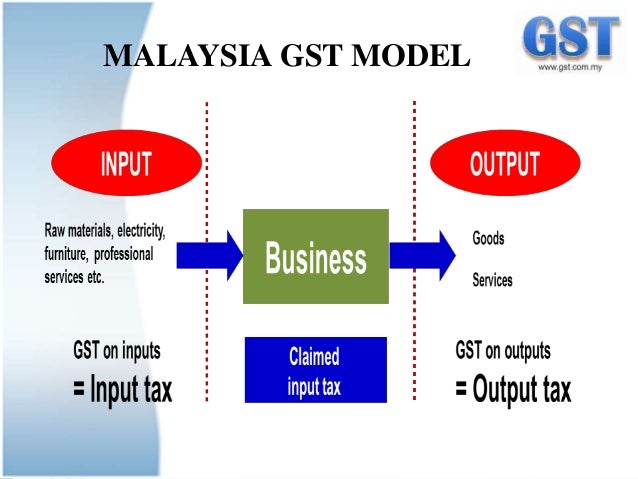

Many domestically consumed items such as fresh foods water and electricity are zero rated while some supplies such as education and health services are gst. The goods and services tax gst is an abolished value added tax in malaysia. Your company s last 12 months sales was less than rm500 000.

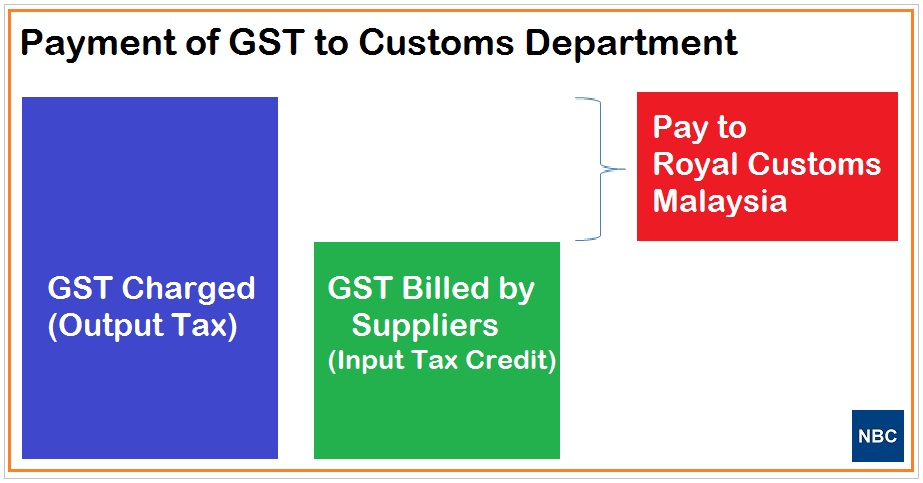

Find out more about tmf labuan and our services here. So turns out you do need to register for tax in malaysia. Gst is levied on most transactions in the production process but is refunded with exception of blocked input tax to all parties in the chain of production other than the final consumer.

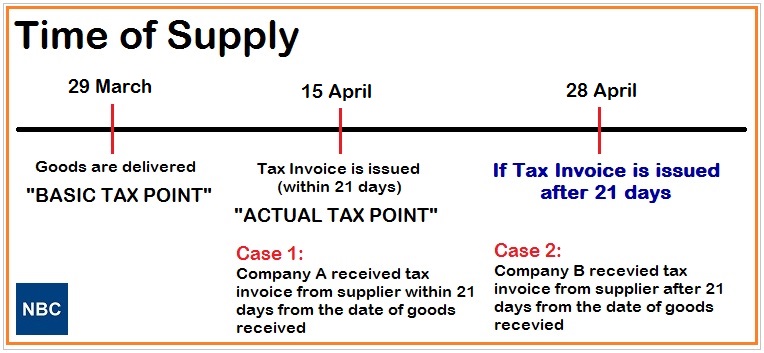

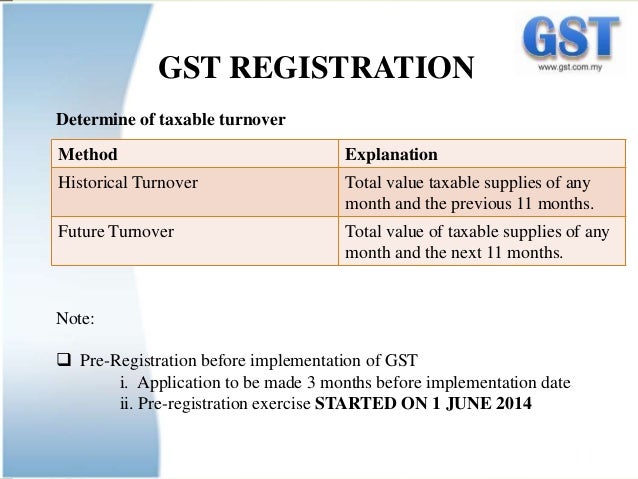

In order to start gst you must first know whether your company is required to be licensed under gst. The existing standard rate for gst effective from 1 april 2015 is 6. If you are one of the following categories you will need not to apply gst license with royal malaysia customs.