Gst Input Tax Malaysia

The registered person is eligible to claim input tax on the gst that has been incurred.

Gst input tax malaysia. A bedding manufacturer who is a gst registered person bought beds and oil paintings worth rm5 000 for use in the showroom of the plant. Malaysia gst blocked input tax credit. Many domestically consumed items such as fresh foods water and electricity are zero rated while some supplies such as education and health services.

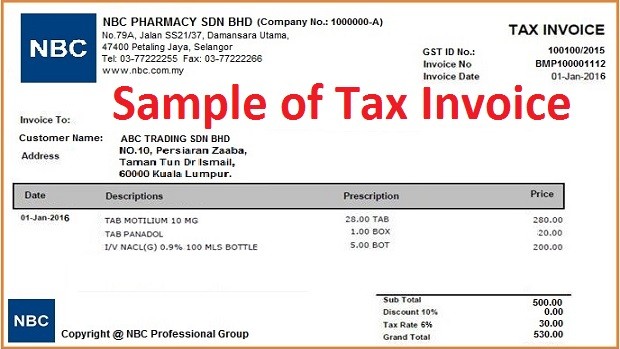

B permit to transship or remove goods k8 e g. Documents that have to be kept are as follows. Under the gst category businesses are allowed to claim gst incurred on purchase of most goods and services.

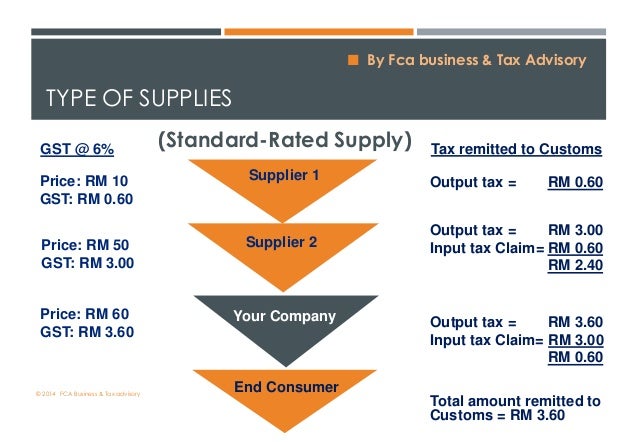

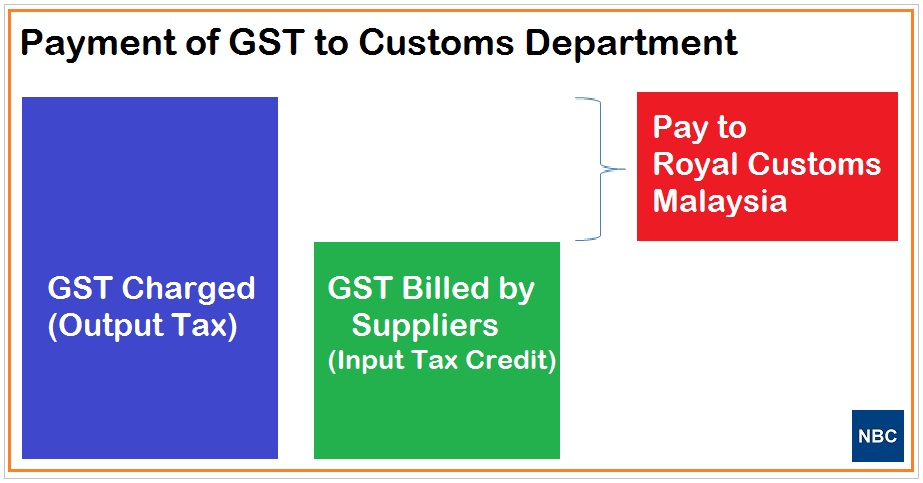

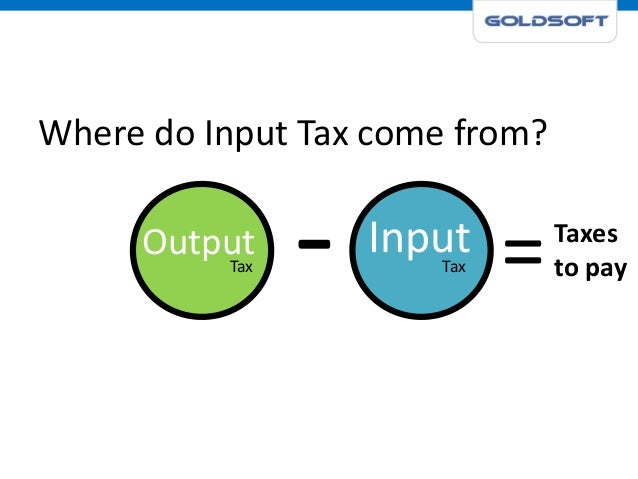

Gst is levied on most transactions in the production process but is refunded with exception of blocked input tax to all parties in the chain of production other than the final consumer. The goods and services tax gst is an abolished value added tax in malaysia. The existing standard rate for gst effective from 1 april 2015 is 6.

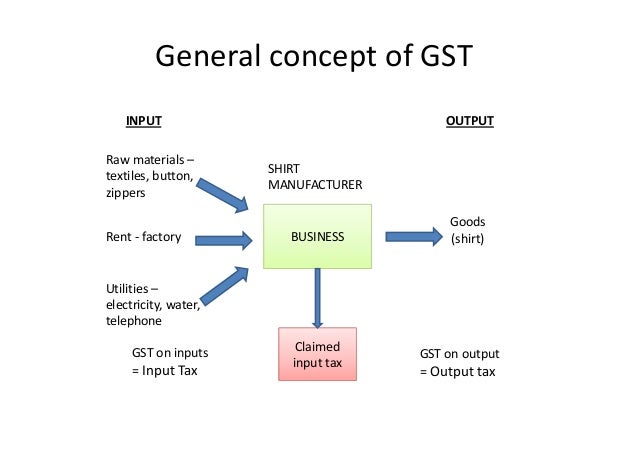

Input tax is defined as the gst incurred on any purchase or acquisition of goods and services by a taxable person for making a taxable supply in the course or furtherance of business. One of the key elements under the gst regime is the recoverability of gst incurred on business expenses by a taxable person i e. Input tax credit itc is goods services tax gst paid or payable by a registered person on the purchases or expenses incurred for the business activities.

The input tax credit. Even though you have not paid any amount to your supplier you can still claim the credit get refund from the customs department. C customs official receipt cor.

Goods removed for outright export from free industrial zone pulau pinang to lta bayan lepas pulau pinang or goods removed from public bonded warehouse to lta bayan lepas pulau pinang. He is eligible to claim input tax of rm200 rm5 000 x 4 since the beds and oil.